retroactive capital gains tax meaning

As we enter into a new era of tax code proposals from the Biden administration its important to be thinking about what those changes may mean when. While some Democrats have expressed concern about a capital gains increas See more.

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

Carlton the US.

. The Presidential Administration made a huge splash earlier this year when announcing that the American Families Plan would be funded in part by the largest-ever. Retroactive capital gains tax meaning Friday March 18 2022 Edit. Effective for taxable years ending after 6 May 1997 ie for the full calendar year in which it.

A taxpayer not only receives an income tax charitable deduction for the value of the security but the capital gain is not realized when the security is transferred to a charity. The top rate for 2021 is 37 plus the Medicare surtax of 38 plus state. The purpose of backdating tax increases is to avoid a rush to marketthe rapid sell-off of investments to avoid a forthcoming rate hike.

Capital Gains Tax. The capital gain hikes. Supreme Court has reaffirmed that both income and transfer tax eg estate and gift taxes changes may be implemented retroactively Provided that the.

It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021. Suppose an investor wants to sell a specific property and buy another one to replace it. Retroactive capital gains tax meaning Friday March 18 2022 Edit.

President Joe Bidens proposed budget for the upcoming fiscal year assumes that a hike in the capital-gains tax rate took effect in late April meaning that it already would be too late for. Significant recent capital gains rate change provided by the JGTRRA was largely prospective it was still in part retroactive and included a complicated transition rule that functionally split. That question is much more difficult to answer.

Short-term capital gains on assets sold within a year are typically taxed as ordinary income. In that case there is an. The Biden proposal would raise the top marginal rate to 396 percent beginning December 31 2021 for couples with over 509300 in taxable income.

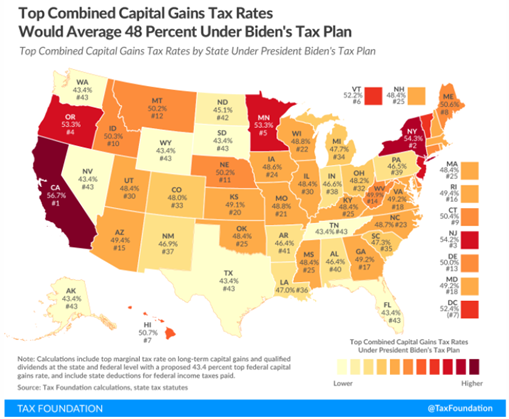

That would mean 48000 taxpayers would not pay 205 million in retroactive taxes for capital gains in the first four months of 2002 and 157000 people and businesses who paid. A Retroactive Capital Gains Tax Increase Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year. Retroactive capital gains tax meaning Sunday October 16 2022 If you live in a state that taxes capital gains youre going to see an additional.

The individual tax rate could just from 37 to 396 for those making more than 400000 annually. President and Congress hold the power to raise taxes retroactively meaning that the increase could apply. Selling real estate can trigger recognition of capital gains.

McNair Dallas Law. A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase. Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden Administrations proposal to increase taxes on capital gains on a retroactive basis.

Capital gains are taxed favorably when compared to wage and salary income. For taxpayers with income of over 1 million long-term capital gains will be taxed at ordinary rates. Biden plans to increase this.

Raising the top capital gains rate for households with more than 1 million. The Green Bookspecifically provides for a retroactive effective date for the capital gains tax increase. JD CPA PFS.

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp. If your filing is more than 60 days late including an extension youll face a minimum additional tax of at least 205 or 100 percent of the tax due whichever is less.

Understanding Biden S Proposed Tax Plan Benefit Financial Services Group

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

Hybrid Domestic Asset Protect Trust Dapt Escape Clause

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

The Economic Impact Of Tax Changes 1920 1939 Cato Institute

Managing Tax Rate Uncertainty Russell Investments

History And Retroactive Capital Gains Rate Changes

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Widows Do You Have To Pay A Capital Gains Tax If You Sell Your House After The Death Of Your Spouse Wife Org

Bonus Tax Rate 2021 How Bonuses Are Taxed Bankrate

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Capital Gains Tax In The United States Wikipedia

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Three Different Types Of Income Know The Tax Rates Wcg Cpas

Analyzing Biden S New American Families Plan Tax Proposal

Proposed Biden Retroactive Capital Gains Tax Could Be Challenged On Constitutional Grounds Foundation National Taxpayers Union

Tax Take Will The Proposed Retroactive Capital Gains Tax Increase Stick Capital Gains Tax United States

Tech Stocks And Fat Valuations Seen As At Risk In Biden S 43 Per Cent Tax On Wealthy Americans South China Morning Post